Individual Donors

Where is my tax credit going?

Valley Tuition Organization puts a high priority on the intentions of the person who made the donation, however, our criteria is not solely based on donor recommendations, Other factors we consider when awarding scholarships include the school, sometimes the income of the family and if the student qualifies for programs that we offer.

Students of any income bracket are eligible to receive some tuition tax credit scholarships and we encourage all students to apply for scholarships.

How do I take the credit?

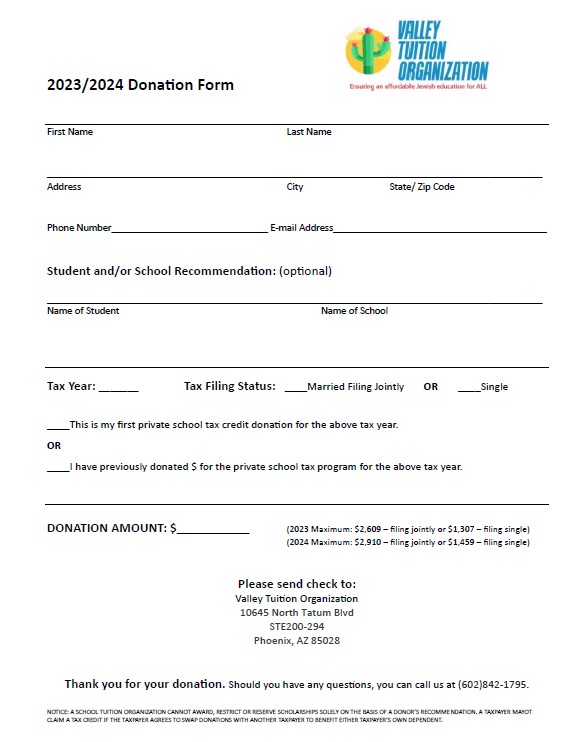

1. Determine the donation amount. Maximum credit in Tax Year 2023 for single filers is $1,307 and married filing jointly is $2,609.

2. Would you like to recommend a school or student? Recommending a student or school is optional, but we will follow the intent of your recommendation to the extent the law will allow. Donations received without a student or school recommendation or donations received in which the recommended student is not eligible for all scholarship funds, will be pooled and awarded to low income families.

3. Make your donation!

4. Take the donation as a dollar-for-dollar credit on your AZ state taxes. In addition, VTO is a 501(c)(3) non-profit. Ask your accountant or tax professional if you can claim a federal tax deduction as well.

Important Rules

- It is against the rules to donate to students with in your own household.

- It is against the rules to swap donations with another family.